ny estate tax exemption 2022

For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. Although the top New York estate tax rate.

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

In other states the estate would pay a tax based on a percentage of the excess amount 890000 but in New.

. Even if a deceaseds estate is not large enough to owe federal estate tax individuals may still owe an estate tax to the state of New York. 16 rows What is the current exemption from New York estate tax again. In 2022 the law assesses no taxes on an individual taxable estate of less than 12000000.

New York State still does not recognize portability. If someone dies in September 2022 leaving a taxable estate of 7 million the estate would exceed the New York exempt amount 6110000 by 890000. It is anticipated to be a little over 6 million in 2022.

Lower Estate Tax Exemption. The New York estate taxthreshold is 592 million in 2021 and 611 million in 2022. This means that if a persons estate is worth less than 611 million and they die in 2022 the estate owes nothing to the state of New York.

As of the date of this article the exact exclusion amount for 2022 has not been released. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The New York States estate tax exemption for 2022 is 6110000 million.

For people who pass away in 2022 the exemption amount will be 1206 million its 117 million for 2021. By contrast New York taxes the entire value of an estate that exceeds the exemption by more than 105. New York State does not recognize portability so unlike federal law which enables a surviving spouse to make use of the deceased spouses unused estate tax exemption New York law requires some extra planning.

The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted numbers. Despite the large Federal Estate Tax exclusion amount New York States estate tax exemption for 2021 is 593 million. If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to estate tax.

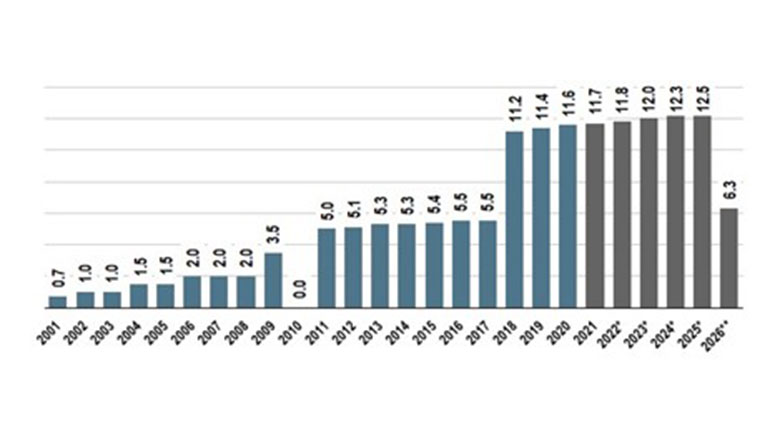

As of January 1 2022 that will be cut in half. Trusts and Estate Tax Rates of 2022. But the exemption amount has changed considerably throughout the years.

The annual rise of exemptions is nothing new. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax.

New York is one of the states that administers their own NY estate tax and has a relatively low NY estate tax exemption amount. This amount remains scheduled to meet the federal estate and gift tax exclusion amount in 2023. The New York estate tax exemption amount is currently 5930000 for 2021.

Subscribe to Sales tax IFTA Miscellaneous tax or Highway use tax HUT emails to. In New York for the year 2022 a single persons estate is subject to tax beyond what New. For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E.

When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount Federally or the basic exclusion amount in New York State. New York Estate Tax Exemption. For a married couple that comes to a combined exemption of 2412 million.

New York Estate Tax. New Yorks estate tax law has a significantly lower threshold. For people who pass away in 2022 the Federal exemption amount will be 1206000000.

Only a small minority of families will have to pay estate taxes to the federal government after a loved one dies. Since the 2021 NYS exemption amount is 593 million estates larger than 6226500 are subject to New York State estate tax rate. The New York estate tax exemption equivalent increased from 593 million to 611 million effective January 1 2022 but continues to be phased out for New York taxable estates valued between 100 and 105 of the exemption amount with no exemption being available for taxable estates in excess of 105 of the exemption amount.

The current New York. This means that if you pass away in 2022 and your estate is valued at this amount or more it will be subject to taxes. Hence the necessity to avoid the dreaded estate tax cliff if possible.

The New York basic exclusion amount will also increase in 2022 from 593 million to 611 million. Fuel taxes suspension. The amount of the estate tax exemption for 2022.

New York estate tax update for 2022. Due to inflation the estate tax exemption has risen this year to 126 million dollars. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

The New York State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 New York State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Additionally the new higher exemption means that theres room for them to give away another 720000 in 2022. This estate will receive absolutely no exemption from New York estate taxes.

That number will keep going up annually with inflation. This means that when someone dies and. The Connecticut estate and gift tax applicable exclusion amount will increase from 71 million to 91 million in 2022.

The New York Department of Revenue is responsible for publishing the. Effective January 1 2022 the 11700000 current federal estate tax exemption amount would drop to 5 million adjusted for inflation Assets held in a revocable trust that is created on or after the legislation is enacted will be included in the tax exemption upon the individuals death effectively preventing the trust from fulfilling its primary intention. The History of the Estate Tax Rate.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. Married couples can avoid taxes as long as the estate is valued at under 2412 million.

The recently enacted New York State budget suspended certain taxes on motor fuel and diesel motor fuel effective June 1 2022. From Fisher Investments 40 years managing money and helping thousands of families. The New York estate tax rate ranges from 5 to 16.

![]()

Irs Tax Problems 10 Celebrities Jailed On Tax Evasion Charges Https Www Irstaxapp Com Irs Tax Problems 10 Celebrities Jailed On Tax Ev Irs Taxes Irs Jail

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Estate Taxes Under Biden Administration May See Changes

What Is The Nyc Senior Citizen Homeowners Exemption Sche

When You Turn 72 You Ll Have To Start Taking Minimum Distributions From Your Traditional Ira And 401 K The In 2022 Required Minimum Distribution Traditional Ira Tax

Tax Exemption Saves Owners Of New Homes In Nassau County

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

2022 Updates To Estate And Gift Taxes Burner Law Group

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

What Is A Homestead Exemption And How Does It Work Lendingtree

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Tax Exemption On Transfer Of Assets Between Holding And Subsidiary Company